Microfinance Software Company in Lucknow

In Lucknow, several companies specialize in offering microfinance software solutions that cater to the needs of small and medium-sized enterprises (SMEs), financial institutions, and microfinance institutions (MFIs). These software solutions are designed to streamline the management of financial services, including loan disbursements, repayments, collections, customer data, and accounting.

Microfinance Software is a digital platform designed to automate and streamline financial operations for Microfinance Institutions (MFIs), Credit Cooperatives, and NBFCs (Non-Banking Financial Companies). It helps in managing loans, savings, group lending, repayments, customer records, and regulatory compliance efficiently.

If you’re looking for Microfinance Software in Lucknow, many IT companies, including Life Info Tech IT Solution, can develop customized solutions tailored to your needs.

With our expertise in technology and a deep understanding of the microfinance sector, Life InfoTech IT Solution is committed to providing cutting-edge software to improve the financial services of our clients. Whether you are looking to automate loan processes or enhance client interactions, we offer tailored solutions that meet your specific business needs.

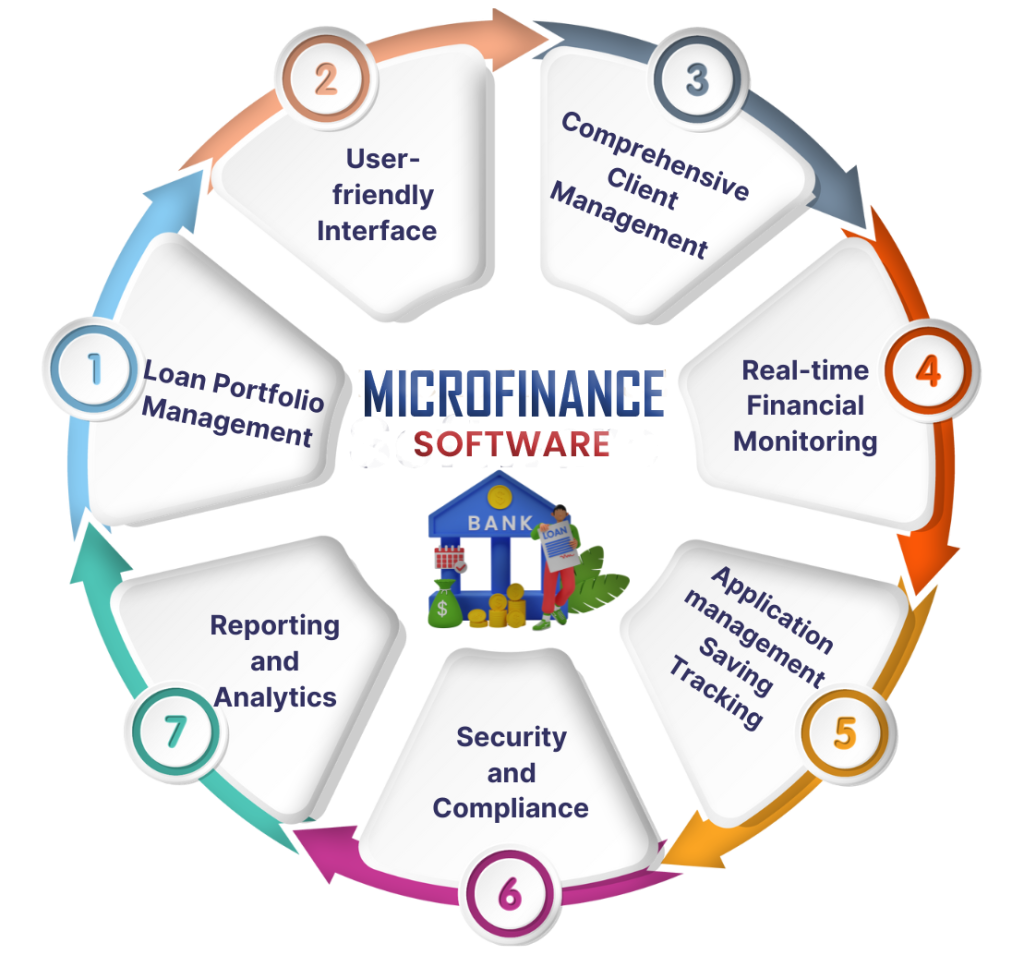

Modules Of Microfinance Software Company in Lucknow

Loan Management System

- Loan Application & Approval Workflow

- EMI Calculation & Loan Repayment Tracking

- Automated Interest Calculation (Flat, Reducing, or Custom Interest Rates)

- Penalty & Overdue Charges Automation

Member & Customer Management

- Customer KYC Verification (Aadhar, PAN, Voter ID, etc.)

- Group Lending & Joint Liability Group (JLG) Management

- Loan Eligibility & Credit Score Check

Savings & Deposits Management

- Recurring Deposit (RD) & Fixed Deposit (FD) Management

- Daily & Weekly Savings Collection

- Interest Calculation & Maturity Alerts

Collection & Repayment System

- Automated EMI Collection & Reminders

- Payment Modes (Cash, Bank Transfer, UPI, Debit Card, etc.)

- Agent & Field Officer Collection Tracking

Accounting & Financial Reports

- Balance Sheet, Profit & Loss Statements

- Cash Flow & Trial Balance Reports

- Tally, GST & Tax Compliance Integration

Branch & Agent Management

- Multi-Branch & Multi-User Access

- Agent Login for Loan Collection & Disbursement

- Performance & Target Tracking for Field Agents

Security & Compliance

- Role-Based Access Control (Admin, Accountant, Loan Officer, etc.)

- Data Encryption & Secure Backup

- Regulatory Compliance (RBI, NBFC, Cooperative Societies Act, etc.)

Integration with Third-Party Services

- Aadhaar, PAN & KYC Verification API

- Banking & Payment Gateway Integration

- UPI & Mobile Wallet Integration (Google Pay, Paytm, etc.)

Custom Reports & Analytics

- Loan Performance & NPA (Non-Performing Assets) Monitoring

- Customer Behavior & Risk Assessment Reports

- AI-Based Loan Default Prediction